Save an average of 30% on your Sapphire + Salt membership and packages by using your HSA/FSA to reimburse your membership fees and services.

How to Use Your HSA/FSA Funds at Sapphire + Salt: You Earned It, Now Use It.

If getting access to healing technologies to support your long-term health is a priority, we have great news for you: You can use your hard-earned HSA and FSA funds towards services at Sapphire + Salt.

We’ve been dedicated to uniting the wisdom of Eastern wellness with the advancements of Western healthcare to help you achieve lasting well-being. That’s why we’ve partnered with Truemed—an organization perfectly aligned with this mission.

Truemed is a payment tool that allows health bands to accept HSA.FSA funds. Think of them as Paypal for HSA/FSA. They partner with leading health brands, like Sapphire + Salt, to facilitate the payment and reimbursement of HSA/FSA funds toward qualified purchases.

What is Truemed?

How to make it happen!

Pay for your services at Sapphire + Salt using your credit or debit card. Do not use your FSA/HSA card.

Complete your Health Assessment on the same day you receive services at Sapphire + Salt.

Complete a 2 minute survey & pay a $20 fee. Your submission will be reviewed by a licensed practitioner.

If eligible, you will receive a Letter of Medical Necessity in 1-2 days in your email. The letter is valid for 12 months of reimbursements.

Truemed will send you instructions to obtain reimbursement from your HSA/FSA administrators. If you are having difficulty submitting a claim for reimbursement, please reach out to support@truemed.com. In the event that Truemed is unable to assist in overturning a claim, the Truemed fee will be refunded.

Click the button below to take the assessment now.

How does using my HSA/FSA save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Consumers save ~30% - no discounting required.

Spending from BANK ACCOUNT

$100 from your wages

-$30 paid in taxes

=$70 available to spend

VS

Spending from HSA/FSA

$100 from your wages

NO TAXES!

=$100 available to spend

Vibration Plate

Red Light Therapy

Lymphatic Drainage

Infrared Sauna

Cold Plunge

Halotherapy

Eligible Products

Sapphire Reset: New Wave Weight Loss System

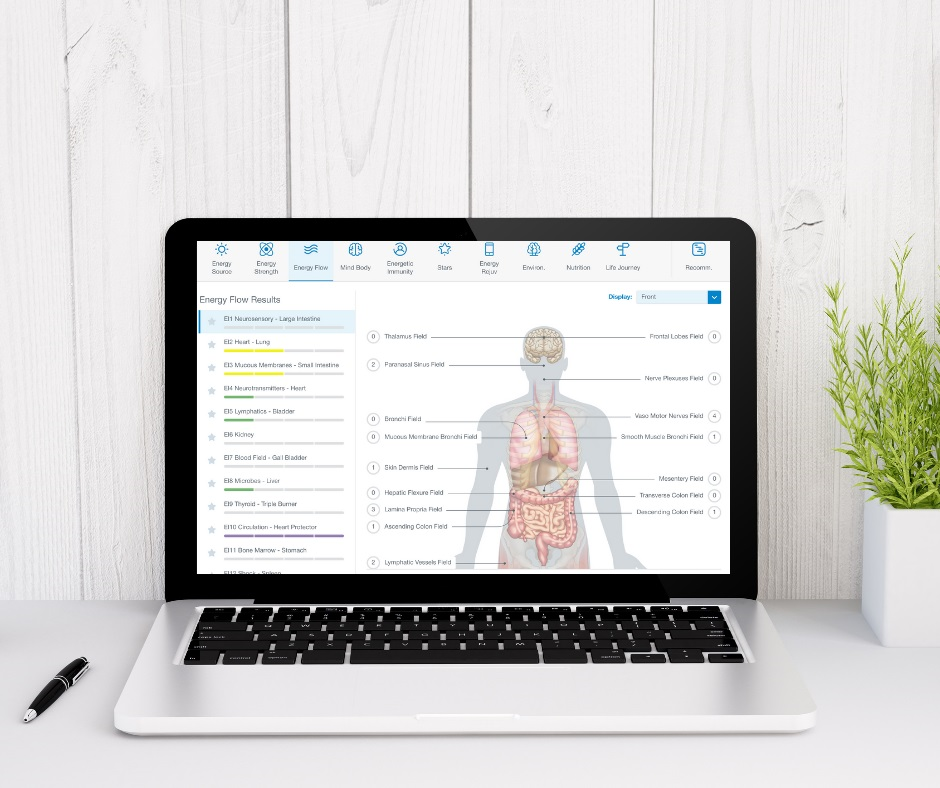

Bioenergetics - Body Scan and infoceuticals

PEMF MiHealth

Hyperbaric Chamber

Common Questions

-

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

-

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

-

We do not recommend attempting to checkout with your HSA/FSA cards for compliance purposes.

We strongly encourage simply transacting with your normal credit or debit card, and submitting for reimbursement as outlined above for the greatest likelihood of success.

-

While this depends on your specific HSA or FSA administrator’s policies, we advise that you only submit expenses incurred on or after the date listed on your Letter of Medical Necessity.

-

For most FSA/HSA administrators, your expenses will be approved within days when you submit your claim for reimbursement along with your receipt and a Letter of Medical Necessity. The exact timing will vary based on your administrator.

-

The items in your Truemed Letter of Medical Necessity (“LMN”) are now qualified medical expenses in the same way a visit to the doctor’s office or pharmaceutical product is. There are thousands of studies showing food and exercise is often the best medicine to prevent and reverse disease. Exercise qualifies as a qualified medical expense with an LMN.

Food, supplements, and other wellness purchases qualify as medical expenses if they treat or prevent an illness, and a doctor substantiates the need.

Your Truemed LMN satisfies all IRS requirements to make your wellness spend fully reimbursable.

-

There is a $20 copay for using Truemed at the end of the qualification survey.

-

You can use your HSA/FSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year. Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

-

Yes. You can still submit for partial reimbursement. For example: if you purchase an eligible item for $100 but only have $60 in your account, you can reimburse $60 of your purchase with your tax-free funds (with the remaining $40 paid for as normal).

-

Please contact us at support@truemed.com so we can help you troubleshoot the issue. HSA/FSA plan administrators often have detailed requirements, so it may be as simple as re-issuing your Letter of Medical Necessity using the administrator’s form. If we are unable to reverse the rejection, we will refund your Truemed fee.